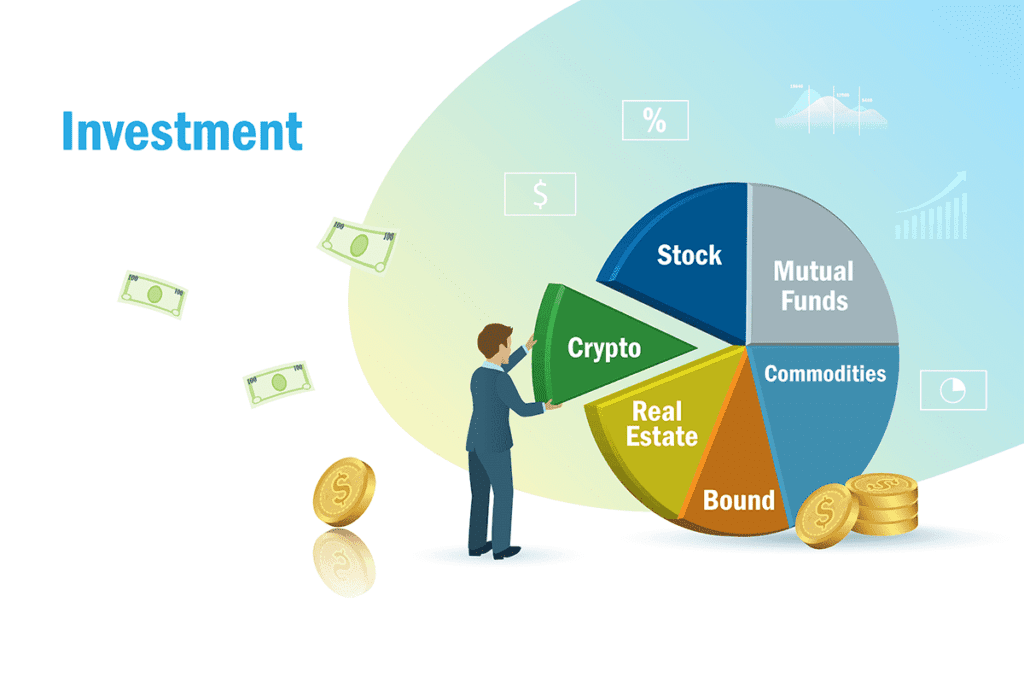

Investments hold significant importance for individuals as they provide avenues for growing wealth, generating income, and achieving long-term financial goals. By investing in various asset classes such as stocks, bonds, real estate, or mutual funds, individuals can potentially earn returns and build a diversified portfolio. Investments offer opportunities to beat inflation, increase net worth, and create passive income streams. They also enable individuals to plan for retirement, fund education, and fulfill aspirations, ultimately providing financial security and the potential for a better future.

Individuals in India have access to a variety of investment options to suit their financial goals, risk tolerance, and preferences. Here are some common types of investments for individuals in India:

Stocks: Investing in stocks involves buying shares of publicly traded companies. Individuals can invest directly in stocks or through mutual funds. Stock investments offer potential for capital appreciation and dividends, but they also carry risks as stock prices can be volatile.

Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They are managed by professional fund managers and offer individuals the opportunity to invest in a variety of securities with different risk profiles.

Fixed Deposits (FDs): Fixed deposits are low-risk investment options offered by banks. Individuals deposit a specific amount of money for a fixed period at a fixed interest rate. FDs provide a guaranteed return on investment and are considered relatively safe.

Public Provident Fund (PPF): PPF is a long-term investment scheme offered by the government. It provides individuals with tax benefits and a fixed rate of interest. PPF accounts have a lock-in period of 15 years and can be extended in blocks of five years.

National Pension Scheme (NPS): NPS is a retirement-focused investment scheme regulated by the Pension Fund Regulatory and Development Authority (PFRDA). It allows individuals to contribute regularly towards their retirement savings and offers a range of investment options.

Real Estate: Investing in real estate involves purchasing properties such as residential apartments, commercial spaces, or land. Real estate investments can provide potential appreciation in property value and rental income.

Gold: Gold is a traditional investment option in India. Individuals can invest in physical gold (jewelry, coins, bars) or gold ETFs (Exchange Traded Funds) that track the price of gold. Gold is seen as a hedge against inflation and a store of value.

Bonds: Bonds are debt instruments issued by the government or corporations to raise capital. Individuals can invest in government bonds (such as the Sovereign Gold Bond Scheme) or corporate bonds. Bonds provide fixed interest payments over a specified period.

Systematic Investment Plans (SIPs): SIPs are a mode of investing in mutual funds. They allow individuals to invest a fixed amount regularly at predefined intervals. SIPs help in rupee cost averaging and provide the benefit of compounding over the long term.

Post Office Savings Schemes: Post Office Savings Schemes, such as Post Office Time Deposit, Monthly Income Scheme, and Senior Citizen Savings Scheme, offer individuals fixed returns with varying investment durations and interest rates.

It’s important for individuals to consider their financial goals, risk tolerance, and consult with financial advisors before making investment decisions. Diversification and regular monitoring of investments are also key factors to ensure a well-balanced and tailored investment portfolio.